- Profit Hacking Weekly

- Posts

- Issue #4: Don't kill your family business...like me

Issue #4: Don't kill your family business...like me

This lesson cost me years of my life and $344,728...it’ll only cost you about 5 minutes

Issue #4 - Don't kill your family business...like me

This lesson cost me years of my life and $344,728 ($44,728 to the IRS). Luckily, it’ll only cost you about 5 minutes of reading to learn from my mistakes.

I killed my grandfather's legacy…

This newsletter is by:

Profit and Grow is a fractional CFO, bookkeeping, and tax planning firm helping professional service businesses earn and keep more money by maximize their PROFIT, minimize their TAXES, improving CASH FLOW, and making the wisest business DECISIONS.

If finance is the most painful part of your business, stopping you from focusing on what you do best, visit profitandgrow.com and book a call today.

We scale businesses to $5m in gross revenue, profitably.

On my 18th birthday, I dropped out of high school.

One week before, a FAU guidance counselor, ruined school for me, forever.

He told us that we could only make this much, with a low, flat hand gesture, with a high school diploma.

With an associate’s degree (2 years of college if you’re not in the US) you can make this much, gestures a little higher.

With a bachelor's degree, this much, gesturing a little higher still.

A MASTER’S degree… this much

Then, very quickly, a professional license, this much, his hand nearly as high as he could reach

And finally, a doctorate.. Yada yada, hand all the way up, you get the idea.

I had checked out.

I could make more than an MBA with a professional license?!

Sign me up!

School wasn’t for me. I tested well but hated homework and projects. I didn’t want 4 more years.

Plus, my grandfather was a BOUNTY HUNTER

Well, he was a Bail Bondsman. But in Florida, to do any bounty hunting you have to be a bail bondsman. So… same same. 🤷♂️

I already planned to get my bail bonds license, and now I had all the validation I needed. And only one week before my 18th birthday.

So, I dropped out, got my GED, and shortly later, my Bail Bonds license.

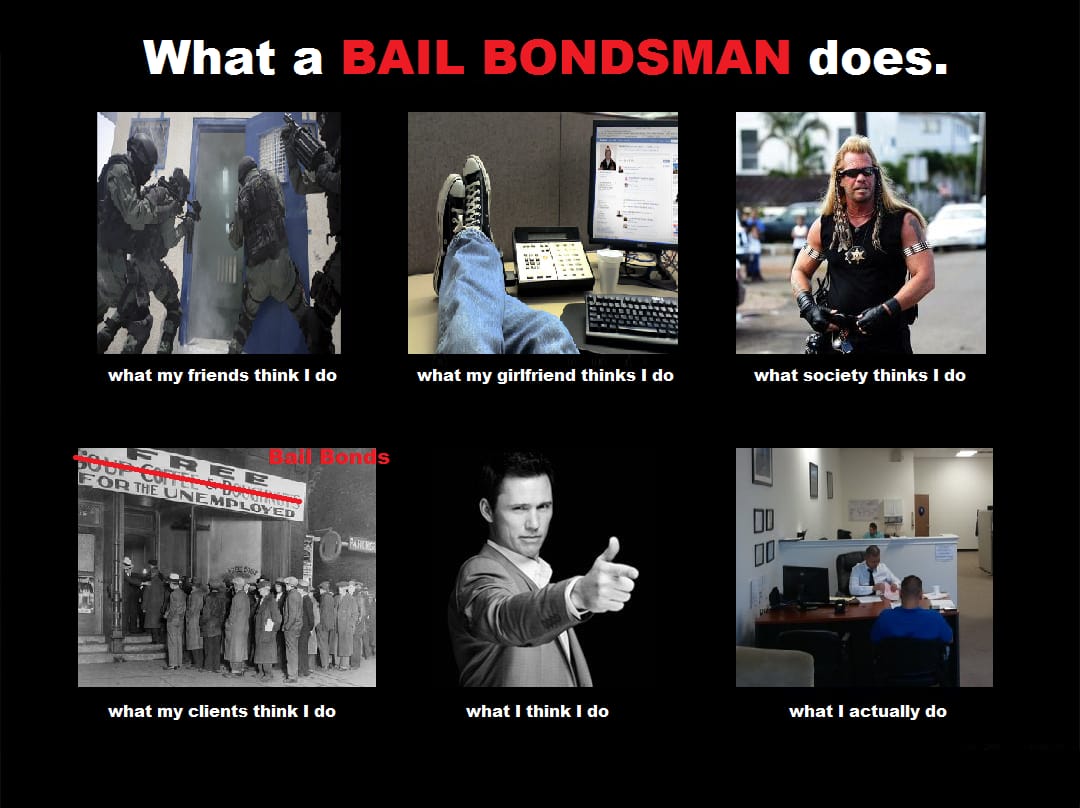

Remember when these were a trend? That’s when I was a bail bondsman

My grandfather, already semi-retired, left me with his Managing Agent as a mentor.

For a few years, things were good. But then, the Managing Agent quit to start his own agency.

At 21 years old, I was ready to take over!

My grandfather disagreed.

He moved back from South Carolina and took the business over himself.

For almost a year we butted heads over EVERYTHING.

The outdated CRM. The outdated phone system. Hiring more agents. Marketing. Expanding to new areas.

True Story:

I once considered starting a business. We were going to hire older, gray haired men. Then have them deliver business ideas and opinions on behalf of the the kid/grandkid. It was kinda genius.

Finally, I quit and opened my own agency.

Outlaw Bail Bonds

My grandfather was furious. It was the ultimate betrayal, short of going to work for a competitor. He was also kinda proud.. it was a weird time.

After 1 year, I heard my grandfather was looking for a buyer for my old family agency. So, I negotiated a price of $300,000 with owner financing and sold my baby agency for enough to cover the down payment.

Finally, I could put all my ideas into effect. And I did.. All at once.

NEW CRM. VOIP PHONE SYSTEM, OFFICE REMODEL. MORE AGENTS. MORE OFFICES.

First order of business… new logo

And it all worked. I was right. I was a real businessman, building, selling, buying, and scaling businesses… until I wasn’t.

Almost 5 years of record revenue year over year, but I never saw a penny more.

It made no sense.

My headache:dollar ratio was ALL out of whack.

Then, during a slow period in the summer, the TAX MAN caught up with me.

I didn’t know, what I didn’t know…

And one of the things I didn’t know was how to pay taxes.

Filing my own tax return made sense, but I didn’t realize I needed to file a corporate tax return. (Yeah, sounds dumb to me too).

My grandfather's CPA retired the year I took over, and I figured I could just do it myself.

That’s not even the cringiest part. I didn’t know a Profit and Loss Statement, Balance Sheet, or Statement of Cash Flow even existed.

I got a bill from the IRS for $44,728. Enough to take out all my savings, my operating budget, and leave the business crippled.

To survive, I scaled back to one office and one agent, plus myself.

Over the next couple years, I tried to build it back. While trying to find a good CPA.

After struggling to work with almost a dozen, I couldn’t find one who would give me the time of day. So I turned to the internet and taught myself all about LLCs and S-Corps.

Tax return preparation and proper accounting.

I LOVED IT.

So I finally gave up trying to resuscitate the business. Instead, I enrolled in college for accounting.

If you happen to be in the exact same situation, let me save you $344,728, years of pain, and an Accounting Degree.

The 3 Greatest Risks to Transitioning a Family Business

Making your Mark

Confidence is essential in business, but Ego is a killer.

I was desperate to “make my mark” on the business. Updating the CRM, hiring people, making more money. So desperate, I completely ignored the fundamentals of running a business.

Granted, my grandfather’s version of bookkeeping was balancing the checkbook on a yellow legal pad. He did do it that way for 20 years. I could have survived it for one or two more while I found a real accountant.

The old 1990’s CRM didn't cost anything and was still supported by the developer. My flashy new CRM cost us hundreds of dollars per month and months to put in place and train everyone.

The offices and employees cost us more. I knew nothing about managing profitability and cash flow, so there was no more profit.

Heed my warning. New ideas are great, but get the fundamentals down for a few years, then try one new idea at a time.

Antiquated Company Goal

I’m not taking all the blame, or putting all the blame on the younger generation.

Many first generation founders have an outdated company goal.

Any new business owner knows that objective #1 is to SURVIVE.

…spend as little as possible, keep the lights on, make payroll, and make sure you see another day.

Unfortunately, many business owners never get that out of their mind. Even when they reach millions in revenue.

This is where the generational gap is the greatest.

The first generation is trying to survive. The second generation never knew the struggles. So all they see are dollar signs. 🤑

Before handing over the business, make sure there is alignment on the company’s goals.

It might not be 10X’ing revenue, but survival also isn’t the top concern anymore.

GET YOUR FINANCIALS RIGHT

Before ever even thinking about exiting a business in any way…

Selling it

Closing it down

Transitioning it to the kid

Make sure everyone understands how to analyze all three core financial statements:

Income Statement

Balance Sheet

Statement of Cash Flow

Without knowing the numbers, you can’t make executive level decisions.

With a solid foundation, both generations can come together and set meaningful goals.

Without the numbers, a decent accountant can’t help you plan and cut the tax bill.

With the financial statements, you can predict the future!

So there it is.

If you want to pass on or take over your family legacy, don’t kill it by

Put off "making your mark" for a few years

Update and align on a company goal

UNDERSTAND YOUR FINANCIALS

If any of this resonates, don't go it alone. Don't let it wear down your relationships. Let me help you avoid my mistakes.

Thanks for reading the fourth issue of the Profit Hacking Weekly newsletter. Past issues will be located on the blog section of profitandgrow.com.

If you need help with anything I talk about, like maximizing your profit, minimizing your taxes, understanding your cash flow, or making the best spending decisions, connect with me on LinkedIn https://www.linkedin.com/in/danielt6/

If you enjoyed this post, please share with a friend so they can join the (22) others who receive these every Saturday.

By: Daniel Talbott